More About Which Method Of Calculating Finance Charge Results In The Lowest Finance Charge?

Prior to anything else can happen, you'll would like to know what your order of business is going to appear like - what jobs can you get with a finance degree. Choose a dependable inspector to examine every aspect of your home from leading to bottom: will you need a new roof or pipes? Are some of the windows in great shape or will you need to plan for an overall replacement? Is anything in that outdated kitchen or bath salvageable? Make a thorough list so you can develop your improvement wish list.

Some renovation loans require you to use specific professionals, so if you are dealing with the bank to make your dream house take place, make certain you get their list of authorized partners. If you can see your home's potential, however not how to spend for it, there are several options consisting of remodelling loans and home equity loans of credit lines.

These are versatile house loans providing house owners access to cash to make house repairs and remodellings through a very first home mortgage rather than a 2nd home loan. HomeStyle Renovation loans are readily available for owner-occupied homeowners in addition to financiers. These involve refinancing with a home mortgage based upon your house's estimated value after renovations are finished.

In some cases called a Rehab Loan or FHA Construction Loan, a 203k loan permits you to refinance your home and required repairs. The federal government backs these loans and lending institutions track and confirm repair work at key points in the process. To receive a 203k loan, you'll require to satisfy the exact same asset, credit and debt-to-income ratio requirements as any other FHA loan.

And you can work with a professional or do the work yourself. A house equity credit line, or HELOC, is normally available just if you have at least 20% equity in your home. These work like charge card: you are offered a revolving credit line to gain access to funds when you require them a plus if your task will take lots of months.

Some Known Questions About What Jobs Can I Get With A Finance Degree.

Rate of interest are adjustable, with most tied to the prime rate. Typically, you can draw from a HELOC for up to 10 years (the draw period). Throughout this time, you may pay interest on the obtained funds. After 10 years, the loan gets in payment, so you'll have a number of choices on how to pay it back: a balloon payment to pay back the entire loan at when or installation payments.

Lenders normally restrict loans to 85% of the worth of your house, and you will repay a home-equity loan much like a mortgage with payments over a fixed term. These loans use tax advantages due to the fact that the interest may be tax deductible for capital improvements on your house. You will get the entire loan up front and pay it off over a regard to 15 to 30 years.

Rates do tend to be slightly greater than those for traditional home mortgages. No matter what home you select, BrandMortage is here to assist pick the best loan for you to fund your dream house. We provide a comprehensive menu of loans to fit your needs. We 'd more than happy to talk to you and introduce you to one of our home loan lenders today.

Purchasing a piece of distressed realty can be an excellent way to snag a dream home at a steep discount. However these houses are frequently in need of repair to bring them approximately date. Given that 1978, the Federal Real estate Administration's (FHA) 203( k) mortgage program has been readily available for property buyers who desire to buy and right away renovate a home.

"FHA 203( k) loans are the best-kept secret in the home loan industry," says Susan Barber, senior vice president for new building and restoration programs for Wells Fargo House Mortgage in Marlton, N.J. "Consumers really should learn about this opportunity for remodelling funding due to the fact that the loans are not just for foreclosures. You can utilize them on all types of properties, even simply an older house that needs upgrading, and they are offered for both purchases and refinancing." Rick Sharga, executive https://apnews.com/Globe%20Newswire/8d0135af22945c7a74748d708ee730c1 vice president of Carrington Home mortgage https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA Holdings in Santa Ana, Calif., states FHA 203( k) loans can help resolve a few of the present problems in the housing market.

Getting My The Trend In Campaign Finance Law Over Time Has Been Toward Which The Following? To Work

" An FHA 203( k) might allow an owner-occupant to buy a home and repair it up, which might slow down the devaluation in the market. Today, just financiers are purchasing these homes and they are buying with money at the most affordable possible cost." Take legal action against Pullen, vice president and senior home loan advisor for Fairway Independent Home Mortgage in Tucson, Ariz., says FHA 203( k) loans were less popular when house equity loans were readily offered.

FHA 203( k) loans are readily available as standard or structured products. The streamlined FHA 203( k) is limited to a maximum of $35,000 worth of repairs, with no minimum repair requirement, Pullen states. Repair work for both basic and simplify loans need to begin within 1 month of the closing and should be complete within 6 months.

" This loan is fantastic for replacing the HEATING AND COOLING or the carpet, replacing the devices or the windows." The standard FHA 203( k) enables for structural repair work, needs a minimum of $5,000 of remodellings and also requires a HUD specialist to supervise the restorations (how to become a finance manager). Both loan types should fulfill requirements for the FHA loan limitation in your area.

5 percent and pay mortgage insurance premiums. Customers need to get approved for the complete loan amount, including the purchase rate and the remodelling costs, with standards comparable to those set by other FHA home loan lenders. Such requirements include a credit report of at least 620 and a debt-to-income ratio of 41 percent to 45 percent.

" An FHA 203( k) loan needs the buyers to make an offer on a home and after that to get at least one bid, but often 2 or three quotes, from a contractor for the repair work costs," says Pullen. "The variety of quotes required depends on the lending institution. So, for instance, if you put an offer on a home at $100,000 and the contractor bids for the repair work that you desire are $20,000, you'll require to receive the loan and make a down payment based on a $120,000 loan." Home mortgage lenders experienced with FHA 203( k) loans can suggest a number of contractors who are have actually worked with the loan program before.

An Unbiased View of What Does Nav Stand For In Finance

In addition, says Sharga, the lending institution will require an appraisal of the current home value and the as-repaired worth, which is based on the approximated value of the home improvements. The home loan amount will be based upon the as-repaired value - how to get a car on finance. The fees for an FHA 203( k) loan are somewhat higher than for a traditional FHA home loan, states Pullen.

5 percent of the cost of repair work, whichever is greater, which can be wrapped into the loan. When repair is complete, requirements require an additional inspection and title policy upgrade to ensure no liens have been filed. Pullen approximates that the additional charges balance from $500 to $800.

" Debtors who think they wish to utilize the FHA 203( k) loan program should ask their Real estate agent and their loan provider if they are familiar with it and to assist them choose if it is a great choice for them," says Sharga. Print page.

The Ultimate Guide To What Is Derivative N Finance

Table of ContentsThe Best Guide To What Is A Finance DerivativeThe Main Principles Of What Is Derivative Instruments In Finance

In addition, the report said," [t] he Department of Justice is looking into derivatives, too. The department's antitrust system is actively examining 'the possibility of anticompetitive practices in the credit derivatives clearing, trading and details services markets', according to a department spokeswoman." For legislators and committees responsible for financial reform associated to derivatives in the United States and somewhere else, comparing hedging and speculative derivatives activities has been a nontrivial obstacle.

At the exact same time, the legislation ought to permit responsible parties to hedge risk without unduly binding working capital as collateral that companies may better employ in other places in their operations and investment. In this regard, it is essential to identify between monetary (e.g. banks) and non-financial end-users of derivatives (e.g.

More importantly, the affordable collateral that protects these different counterparties can be very various. The distinction between these firms is not constantly direct (e.g. hedge funds or even some private equity firms do not nicely fit either classification). Finally, even financial users must be differentiated, as 'big' banks may categorized as "systemically substantial" whose derivatives activities must be more securely monitored and restricted than those of smaller, regional and local banks (what is derivative market in finance).

The law mandated the cleaning of certain swaps at registered exchanges and enforced various limitations on derivatives. To implement Dodd-Frank, the CFTC established brand-new guidelines in a minimum of 30 locations. The Commission figures out which swaps undergo necessary clearing and whether a derivatives exchange is eligible to clear a specific kind of swap agreement.

The challenges are even more complicated by the requirement to manage globalized financial reform among the nations that consist of the world's significant financial markets, a primary duty of the Financial Stability Board whose progress is continuous. In the U.S., by February 2012 the combined effort of the SEC and CFTC had actually produced over 70 proposed and final derivatives guidelines. For example, a trader might attempt to benefit from an expected drop in wesley remote an index's cost by selling (or going "brief") the related futures contract. Derivatives used as a hedge permit the risks connected with the underlying asset's rate to be moved in between the celebrations involved in the agreement (what finance derivative). A derivative is an agreement in between 2 or more celebrations whose value is based on an agreed-upon underlying financial property, index or security.

How What Is Derivative In Finance can Save You Time, Stress, and Money.

Derivatives can be used to either alleviate risk (hedging) or assume threat with the expectation of commensurate benefit (speculation). For example, commodity derivatives are used by farmers and millers to provide a degree of "insurance." The farmer goes into the agreement to secure an acceptable price for the commodity, and the miller goes into the contract to secure an ensured supply of the https://www.elkvalleytimes.com/news/business/wesley-financial-group-provides-nearly-million-in-timeshare-debt-relief/article_4be24045-0034-5e07-a6ac-d57ec8d31fcd.html commodity - what is derivative market in finance.

Top Guidelines Of Personal Finance How To Make Money

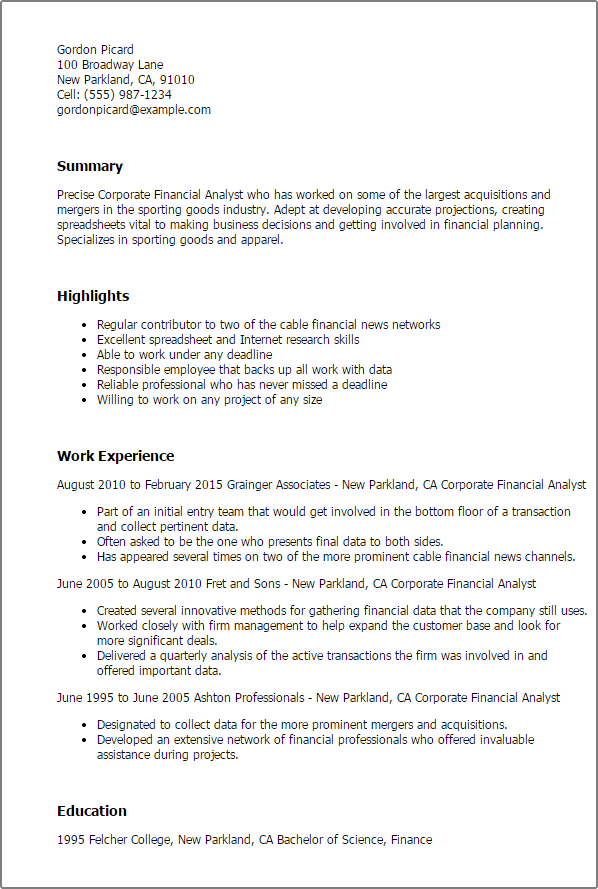

population on a monthly basis." A Wealth of Sound judgment is written and handled by Ben Carlson. Ben is a Chartered Financial https://www.inhersight.com/companies/best/reviews/telecommute?_n=112289508 Expert (CFA). Ben's focus is on wealth management, investments, financial markets, and investor psychology. Ben is the director of institutional management for clients of Ritholz Wealth Management, LLC, among the most acknowledged names in the guidance industry.

From the site:"Every Wednesday, you can listen to a brand-new episode of my podcast Animal Spirits with Michael and Ben. Fortune called Animal Spirits to its list of Best Business Podcasts."If you're an investor searching for insights and knowledge about your investment portfolio and the monetary markets, drop in A Wealth of Sound Judgment.

physician and among the O.G. bloggers, particularly amongst physician blogs. Like many doctor bloggers, Dr. Dahle decided to find out about individual finances after having numerous financial advisors' bad experiences. He dove in to discover personal finance and investing. As a doctor and high-income professional, he was particularly interested in learning the important things that would assist him and others in the high-income arena. Cash Mustache is a reputable individual financing site. It's written by a guy who was tired of the rat race of the corporate life he and his better half were living. They desired to start a household, so they chose to retire. What? Retire to start a family?Yes! That's what makes this site so valuable.

He started this blog in 2005 at age 36. Pete says he made it because he "lived a way of life 50% below his peers." He saved a lot more than most. Not earth-shattering, but extremely difficult to carry out. You can read his entire journey to monetary liberty, starting with his first article, written on April 6, 2011.

There are numerous articles and recommended resources, a MMM Classics page, representing choices picked by Mr. Mustache. It's an enjoyable site, however chock-full of excellent product to assist you manage your finances.The cash Saved is Money Made blog is one of the more distinct blogs I've discovered. What makes it special is that the blog site has 2 owners and authors, Tawnya and Sebastian. This one, nevertheless, is unique due to (m1 finance how they make money).

the varying backgrounds of the partners. Sebastian is an immigrant from India. He concerned America when he was 22 years https://www.bizjournals.com/nashville/c/meet-the-2020-best-places-to-work/12253/wesley-financial-group-llc.html of ages with little money and little family in the Portland, OR area where he landed. Sebastian worked two tasks while putting himself through college. He ended up working as a senior financial analyst for the city.

Tawnya, on the other hand, is a special education teacher in the Portland school system. Tawnya has worked hard, frequently taking part-time tasks, to pay off her student loan debt. She recently purchased her very first home, conserving enough for a 20 %down payment. Examine it out here https://www. moneysavedmoneyearned.com/Jesse Cramer is the creator and author of The very best Interest blog. Jesse is an engineer. As such, he's never discovered a technical subject he couldn't cover in fantastic information. One of the blog site focuses is taking intricate issues and breaking them down into quickly comprehended language. If you wish to explore whatever from individual finance basics to complex topics like the Satisfaction Curve, The Finest Interest is a location you wish to check out. Inspect it out here https://bestinterest. blog/Jessica Bishop founded The Spending plan Savvy Bride in 2008 afterpreparing her affordable wedding, and the site has actually grown to become the go-to resource for couples who wish to have a stunning wedding on a spending plan. The Budget Savvy Bride also features loads of amazing money-saving suggestions, motivation posts, and advice for keeping things in point of view while planning. Not to discuss, there are also DIY task tutorials and totally free wedding printables to help you craft ornamental information to make your wedding look luxe for less. Couples shouldn't go into debt to pay for a one day celebration, so Jessica's focus is to help couples pull off the finest wedding they can have on the spending plan they can pay for. com The Be Three blog author has her photo on the blog but picks to stay anonymous (we'll call her Be Three). We understand Be 3 is well educated. She is a physician who also has an MBA. From the midwest at first, she now practices medicine and resides someplace in southern California. Her posts focus on using individuals ways to accomplish all of these things. The underlying message is among self-improvement. From her about page: The idea with this blog is to help build individuals up, keep them motivated, and encourage everybody that even the most improbable vision of yourself in the future can become a reality. Be 3 describes herself as a passionate tourist, food lover, and says she's a licensed book worm. If you would like to know how to travel to other nations and get the most out of your time, take a look at some of her travel posts while you're there. Examine it out here https://www.

How Dealership Finance Officers Make Their Money for Dummies

They were broke and desperate for a modification and followed Dave Ramsey prior to discovering monetary self-reliance and early retirement. They settled over $35,000 in debt while in college while conserving for a home down payment and their wedding event. Numerous years later, they now save over 50% of their income with hopes of achieving early retirement!Their goal is to assist families discover their FIRE version through budgeting, conserving, investing, side hustles, and travel hacking. in Financing, and an MBA degree that she utilized at a top financial firm prior to quitting her task to pursue their side hustles full-time. They want other individuals to be able to pursue their enthusiasms due to clever money management, too. Inspect it out here https://www. howtofire.com Written and handled by Melanie Allen, Partners in Fire started in 2017.

In retirement, she desires to return to school and research study anthropology. Discuss eclectic!In addition to focusing on FIRE, Melanie likewise focuses on way of life posts. From her website: "Partners in Fire is a monetary independence and lifestyle blog site, with a huge focus on the lifestyle part. In truth, our main focus is to embody the spirit of financial self-reliance, rather than the technical aspects of it.

You will find some dependable monetary independence content and a vast array of other informative posts on various subjects. Check it out here https://partnersinfire. com/Invested Wallet was begun in the Summer season of 2018 to help newbies and beyond get more control over their cash and discover how to invest. The website was established by Todd Kunsman, who, since 2014, taught himself whatever about individual financing and investing while enhancing his.

profession worth.

Not known Details About Why Do Finance Make So Much Money Reddit

According to American Banker, Loaning Club and Prosper have actually been backed by prominent venture capitalists. Other popular P2P online platforms consist of Fundation, Financing Circle, and QuarterSpot. If you have an excellent idea for an organization, but need a great deal of assistance (both cash and assistance) in getting it up and running, an organization incubator might be the way to go if you can get your company into one.

Organization incubators are run by equity capital companies, federal government firms, and universities with the objective of supporting new business through their earliest stages by supplying marketing, networking, facilities, and funding support. Idealab is a fine example of a company incubator. Established in 1995 by legendary Pacific Investment Management Business (PIMCO) co-founder Costs Gross, IdeaLab states it has assisted launch 125 business, 40 of which have actually gone on to hold an IPO or be obtained by a bigger business.

Requirements vary amongst various incubators, but the entrepreneur needs to demonstrate a strong probability of success for the service. Competitors for an area in an incubator can be very tough. A listing of service incubators in the U - how much money can you make with an accounting and finance degree.S. can be gotten through the National Company Incubator Association. Unless you're already a millionaire, assembling the funding to release a brand-new company takes serious preparation and effort.

But you don't need to limit those options. Numerous small services are begun with money obtained from a mix of different sources. Even if http://felixlvec334.theglensecret.com/h1-style-clear-both-id-content-section-0-the-smart-trick-of-why-does-soft-money-make-it-hard-for-congress-enforce-campaign-finance-reform-that-nobody-is-talking-about-h1 you land a considerable bank or SBA loan, you might still need additional cash from family and friends, or yourself, to make your startup dream come to life.

Luckily, the rise of brand-new financing sources like crowdfunding and peer-to-peer lending suggests that prospective little business owners now have a greater series of funding options at their disposal than ever before. How will you fund your small company startup?.

7 Simple Techniques For How To Make Money Through Finance

Money is a tool that can assist you to accomplish your goals (how to make money in finance on your own). It can provide comfort and stability for your household, make it easier to prepare for the future, and allow you to conserve towards important milestones. However to achieve these things, you need to know how to make your cash work for you.

You may become able to acquire monetary self-reliance or build wealth through investing. However neither of those things can occur without very first understanding where your money is going and learning much better ways to utilize it. A budget is an important tool for changing the method you manage your money.

You are making your money do what you want it to do, rather than costs without a plan. The objective of budgeting is to constantly invest less than you make. When you produce a budget plan, you assign every dollar you earn to a costs category. You can use a budget plan to: Lower your spendingUnderstand where your money is goingIdentify bad financial habitsPay off debtAvoid creating brand-new debtPrioritize spending on things that are very important to youSave for the future Budgeting is not a one-time action.

You might require to adjust your budget plan from month to month to represent large costs or your own costs practices. When you understand how much income you have, you can choose where to put it. When you are intentional about where you invest it, you are in control of your money.

When you are in debt, you pay more than the expense of the initial purchase. You likewise need to make interest payments that can considerably cut into your earnings. Debt means your cash isn't working for you, it's going towards paying that interest. It develops a monetary burden and restricts the options that you can make.

Some Ideas on How To Make Money Filecoin Finance You Need To Know

You can put it toward other monetary objectives, such as saving for education, creating a retirement fund, traveling, or enhancing your living scenario. You can start an organization. You can begin investing it, allowing you to grow your wealth and produce more financial stability and independence. If you have a great deal of financial obligation and are feeling overwhelmed, you can utilize the snowball approach to control the debt payment procedure.

Put whatever additional money you have towards paying off the smallest financial obligation. Once it's settled, move onto the next smallest. how to make money in finance on your own. As you settle your smaller financial obligations, you'll have more cash offered to pay off your bigger financial obligations. This momentum assists you focus your efforts and get out of debt faster.

An unexpected cars and truck repair, a medical procedure, a task loss, or any other financial emergency situation can rapidly send you spiraling into new or more financial obligation, erasing any development you have actually made towards taking control of your cash. Developing an emergency situation fund is another way to make your money work for you due to the fact that it indicates you have actually planned for surprises.

Constructing an emergency situation fund can take some time. Ideally, you ought to conserve the equivalent of three to 6 months' worth of earnings. However every little bit you can reserve will assist. If you are still paying off debt or don't have much wiggle space in your spending plan, set aside whatever you can in a "surprise expenses" classification in your budget.

Put your emergency situation savings in a high-yield savings account, which will make more interest than a regular conserving or checking account. This indicates that the cash you conserve will earn money while it's being in your savings account. If your bank does not provide high-yield accounts or you reside in a rural area without a bank, try to find online banking options to open an account.

7 Simple Techniques For How Much Money Do Finance Majors Make

Once you have actually maximized all that additional cash from paying off your financial obligation, you can put your money to overcome savings and investments. What you save for will depend upon your age, lifestyle, and objectives. In addition to an emergency fund, you will also require pension. You need to also consider whether you require: Education cost savings, for yourself or your childrenTravel savingsA deposit fund for a houseSavings to begin a businessA car fund, for repair work or a brand-new vehicleExtracurricular fund for dependentsLong-term care cost savings, on your own or dependents By creating designated savings funds, you can track your progress towards particular goals.

Remember, when you pay interest, you are losing cash. However when you make interest, your cash is making more cash all by itself. If you won't need your savings for a number of years or years, one of the very best methods to make your money work for you is to invest. When you put your cash into financial investments, it grows all by itself through interest or the increased worth of the important things you bought.

Investing is a long-term technique for building wealth. The most effective investors invest early, then enable their money to grow for several years or years before utilizing it as earnings. Continuously purchasing and offering investments is likely to make less cash than a buy-and-hold strategy in the long run. As you start investing, it is important to diversify your portfolio.

A Biased View of How To Make Money In Personal Finance

In highschool, my friend and I checked out a giant book of jobs and their incomes. We instantly flipped to the end to find the one that paid the most money. It was a financial investment lender. Without a doubt, we both declared we were going to be financial investment lenders.

I want I had understood how many options I actually had. I might have focused on a course that would have been a much better fit right from the beginning. Turns out, there's a lot of tasks that pay a lot of cash. Whether you're still in highschool or making a career change, you have a great deal of choices. A lot of positions within corporate finance requires a minimum of a bachelor's degree, and master's degrees or MBAs are frequently chosen. Business financing professions have a high earning potential, and numerous corporations supply considerable benefits to their employees. Some professions you might consider in corporate financing include: The banking sector offers many intriguing career positions, and several careers in banking and finance are experiencing task growth.

You may wish to consider tasks like: If you're interested in finance however want a customer-focused profession devoted to growing properties, you need to highly consider a profession in investment. Financial investment profession positions are involved with the management of properties for individual and business clients and make suggestions as to ways these people and corporations can maximize their gains and prevent costly monetary errors. how much money do you have to make to finance a car.

These careers require little, if any, previous work experience and will include some level of professional knowing and job training. While a degree is not always a pre-requisite for these tasks, many companies choose candidates with some college education,, such as an associate or bachelor's degree. The following careers are appropriate for those at the outset of their expert practice in financing: Many careers within the field of finance are lucrative, with wages well above the median for U.S.

Nevertheless, if you only wish to pursue careers that are thought about the best of the best you might wish to consider the following: Other high-paying finance professions to think about are typically at the management level, which might require more education, such as an MBA. A master's degree or MBA in finance unlocks to brand-new job chances or profession advancement within a finance profession.

If you're trying to find tasks with a master's in financing, you might desire to consider: Internships are a fantastic method to acquire real-world experience and prepare yourself for operating in the field. Lots of degrees in finance either need or offer relevant internships; a few of these are paid, a lot of are not.

The smart Trick of How Much Money Can A Finance Major Make That Nobody is Talking About

If you're online, you might need to take a trip, though some online schools can assist you schedule an internship in your area. A few of the most popular and best internships in financing are: AT&T Financial and Leadership Advancement Program Northwestern Mutual Financial Network Credit Suisse Lazard J.P. Morgan's Investment Bank As you start considering a financing degree and taking a look at schools with financing programs, you must highly think about the profession you're most interested in, as you may wish to customize your research studies to the career paths you desire to pursue.

Some popular industry choices include banking, insurance coverage, and business finance, and the profession options offered within these industries vary. If you have no education or market experience, it is still possible to acquire an entry level job in finance and work your method up. Nevertheless, you'll likely have a higher chance https://vimeo.com/user64148215 at obtaining work with an http://www.wesleytimeshare.com/chuck-mcdowell-article/ associate degree, or, even better, a bachelor's degree in financing.

Financing specialists with more experience and education can move into more complex finance functions or end up being supervisors who supervise operations and workers in entry-level positions.

Financing is the lifeline of business world. Basic material aren't processed, factories aren't built, items aren't delivered and consumers aren't pleased unless the money that makes it occur is present at the correct time and place. It's an understatement to state that the financing market is big, varied and extremely important; people in finance careers are the individuals who develop, broker and track almost every monetary deal.

Take an appearance at some of the incomes for popular professions in finance: Financing CareerMedian Annual Income * Actuary$ 100,610 Financial Manager$ 121,750 Personal Financial Consultant$ 90,530 Financial Analyst$ 81,760 Securities, Commodities and Financial Solutions Sales Agents$ 67,310 Source: U.S. Bureau of Labor Stats' 2018-19 Occupational Outlook Handbook * The income details listed is based upon a national average, unless kept in mind. Real wages might vary considerably based upon specialization within the field, place, years of experience and a range of other aspects.

Included Bachelor's and Master's Programs Nearly any finance task will bring you an above average financing income. And, if you want to put in the time and effortsustaining a reasonable amount of threat and pressure and carrying out well in your positiona financing task simply might make you abundant. While monetary advisor careers sit at the lower end of the financing market's income spectrum, the U.S.

How Much Money Does Auto America Finance Manager Make? Fundamentals Explained

The investment banking field is most competitive and consequently supplies increasing incomes, however these tasks are mainly restricted to significant banking centers, such as New York City or Los Angeles, and demand exceedingly long hours. Corporate financing jobs sit mid-range, with compensation mostly connected to factors such as the quantity of private responsibility.

Bureau of Labor Data, the demand for finance professions will vary by the area of finance in which you pick to specialize. The recruiting firm, Robert Half International, states that while basic unemployment stays high, university-degree holders with specialized skills in locations such as financial analysis will fall well listed below the nationwide unemployment average.

Take an appearance at how some of the finance occupations compare as far as job development: Actuary18 percent, much faster than averageFinancial Supervisor 19 percent, much faster than averagePersonal Financial Advisor30 percent, much faster than averageFinancial Analyst 11 percent, faster than averageSecurities, Commodities and Financial Services Sales Agents10 percent, a little faster than average Source: U.S.

In their post entitled "One of the Fastest-Growing Professions remains in Desperate Need of Young Talent," Forbes asserts that a person financial job that's stayed secure and progressively pertinent in today's market is the financial consultant. This is since Baby Boomers are approaching retirement and require aid preparing for a financially safe future, mainly, and likewise due to the fact that the average finance advisor presently working is 50-years-old and nearing retirement as well.

How To Make Money In Finance Fundamentals Explained

Some companies may need expert certification in addition to an academic degree. Southern New Hampshire University offers an online degree alternative for students with career aspirations in personal financial recommending. This BS in Financing with a concentration in Financial Preparation requires trainees to take courses such as Principles of Finance, Financial Strategy Development, Danger Management and Insurance Planning, and Advanced Personal Financial Preparation.

A strong on-campus alternative would be Texas Tech's BS in Personal Financial Planning degree program. The program boasts immersive internship chances and a job positioning rate of over 90 percent. It's also understood for its elite professor who concentrate on various areas of monetary planning, consisting of estate preparation, investments, retirement, risk management, and more.

A few of their duties might include acquiring stocks and bonds on behalf of people or corporations, advising companies on investments, selling commodities, and serving as monetary experts for mergers and acquisitions, for example. Jobs for securities, products, and financial agents are growing gradually according to the Bureau of Labor Stats (BLS) (how to make a lot of money with finance blog).

A minimum of a bachelor's degree is needed to end up being a securities, commodities, or monetary representative, preferably in finance, company, or economics. Many potential representatives go on to earn an MBA credential, which can increase their possibilities of employment and/or advancement. Trainees thinking about this career course might think about the University of Alabama Birmingham's practical online Bachelor's degree in Financing.

For students trying to find an on-campus program, the College of William & Mary provides a financing significant through its renowned Raymond A. Mason School of Service. Trainees registered in the program will take classes like Corporate Financial Strategy, Equity Markets & Portfolio Management, and Cash & Financial Obligation Markets. Another high-paying financing degree job is that of an actuary.

These monetary specialists need to utilize data to identify the possibility of specific events such as diseases and natural disasters and predict the financial losses associated with the event. They may be asked to utilize their findings to create insurance plan and other monetary documents in such a way that takes full advantage of a company's earnings margin.

The 9-Second Trick For Personal Finance How To Make Money

Other kinds of actuaries consist of enterprise risk actuaries and retirement advantages actuaries. Jobs for actuaries are growing much faster than average. Even so, the need for actuaries will still stay reasonably small compared to other professions in the monetary industry. To become an actuary, applicants will need a bachelor's degree in actuarial science or an associated field such as mathematics or data.

The University of Wisconsin uses a Bachelor of Organization Administration (BBA) program with a concentration in Actuarial Science. Requirements for the significant consist of course titles such as Intro to Theory and Approaches of Mathematical Stats, Actuarial Science Approaches, and Introduction to the Theory of Possibility, for instance. The school has actually been called a National Center of Actuarial Excellence by the Society of Actuaries.

Summer internship chances are available. Monetary analysts are tasked with examining the finances of a business or private and making recommendations concerning their financial health. These suggestions could consist of advice and direction on stocks and bonds along with other investments. Finance degree tasks in financial analysis require professionals to work closely with hedge funds, independent cash supervisors, or nonprofits.

One might pursue a career track as a threat expert, portfolio manager, scores expert, or fund manager, for example. The Bureau of Labor Data (BLS) reports that work positions for financial experts are growing about as fast as average. Still, competition for these jobs has actually been strong in the past and is anticipated to stay so.

Generally, those individuals who desire a career in monetary analysis will need a bachelor's degree for entry into the field. Generally, employers will wish to see an academic records that shows success in courses such as mathematics, stats, accounting, and economics. Penn State World Campus uses a flexible online degree program that offers appropriate preparation for students who wish to pursue a profession as a monetary analyst.

According to U.S. News & World Report, the University of Pennsylvania is house to the very best on-campus bachelor's in finance program in the country. Coursework may include classes such as Financial investment Management, International Financial Markets, Capital Markets, and Venture https://www.forbes.com/sites/christopherelliott/2020/06/27/how-do-i-get-rid-of-my-timeshare-in-a-pandemic/#53347f866a07 Capital and the Finance of Development, for instance. Accountants and auditors are accountable for tracking a company's monetary files.

An Unbiased View of How To Make Big Money In Finance

Other duties needed for these financing degree tasks might include preparing tax returns, maintaining financial records, and auditing represent legal compliance. There are various types of accounting professionals and auditors, including accountants, internal auditors, government accountants, and infotech auditors, for instance. The demand for accounting professionals and auditors generally ebbs and streams in relation to the growth and health of the overall economy.

Just like other tasks in the financial market, however, competitors for positions in accounting and auditing will be strong. Candidates with professional accreditations such as Qualified Public Accountants (CPA) and those with a sophisticated credential such as a master's degree or MBA in accounting will have the best possibilities of protecting preferable positions in the field.

Davenport University offers a top online Bachelor of Organization Administration (BBA) with a concentration in Accounting certified by the International Accreditation Council for Service Education (IACBE). The university ensures that graduates of the program will be gainfully employed in the accountancy market within six months of degree conclusion. Another top choice for potential accounting professionals and auditors is Washington State University's major in accounting.

Spending plan analysts are responsible for developing, preserving, and enhancing an organization's spending plan. This might consist of dealing with supervisors to develop a working spending plan, examining the present budget plan for accuracy and compliance, and monitoring business costs, for instance. These monetary specialists will also be required to prepare and present reports to managers and stakeholders regarding an organization's spending plan and monetary status.

Job applicants can anticipate relatively steep competition for readily available positions in the field. Typically, a bachelor's degree is required for work as a budget plan analyst. Though no particular degree path is designated, companies typically try to find a scholastic background in accounting, financing, stats, mathematics, or economics. Thomas Edison State University provides a practical pathway to a profession in https://www.businesswire.com/news/home/20200115005652/en/Wesley-Financial-Group-Founder-Issues-New-Year%E2%80%99s budget analysis through its online Bachelor of Arts in Mathematics.

The program is also transfer-friendly. Additionally, trainees might elect to pursue a bachelor of economics degree such as the one offered by Oregon State University. This online program is especially flexible, including both Bachelor's Degree and BS tracks. Students can likewise specialize their studies by choosing among 3 offered focus locations.

The 45-Second Trick For How To Make Money Blogging On Finance

These monetary specialists may be entrusted with investigating the cost of products and services, creating spending plans, and advising cost-saving steps. The Bureau of Labor Statistics (BLS) reports that jobs for expense estimators are on the rise and growing faster than average. The demand for these finance degree tasks is constant with corporations' ongoing requirement to keep track of costs connected with business operations in order to take full advantage of revenue and revenue.

How To Make The Most Money With A Finance Degree Things To Know Before You Get This

"They're being paid to offer item. They're not being spent for baseline compliance due to the fact that there's no cash in a tidy file," Ganther stated.

Two years back, James Seale attempted something various. Would a revamped and lower-paying settlement prepare for financing supervisors harm product sales and department performance? Seale, basic manager of Southwest Kia in Mesquite, Texas, states the response is now clear: No (how much money can you make with an accounting and finance degree). The dealership switched from an all-commission pay prepare for financing supervisors to salary plus perks.

However they get more time off, and productivity is increasing, Seale states. "What we're discovering is we don't have to pay the higher total up to get the exact same production," he says. "And we have actually got better people because they're not working 80 hours a week." Rather, finance managers generally work 40 to 45 hours a week.

The turnover has permitted the dealership to promote good performers from the sales flooring to fund - how much money do you make out of college in a finance job. They generally are younger workers recruited straight from college who don't anticipate the higher payment levels the dealership utilized to pay. Southwest Kia is one of numerous dealers experimenting with methods to get more bang for the buck in the F&I department.

Others have hired junior-level F&I staffers to settle a few of the work - how to make money with a finance degree. The experimentation makes many financing supervisors anxious. However financing supervisor payment is typically increasing as dealers http://remingtonotud593.huicopper.com/the-facts-about-how-much-money-do-directors-of-finance-in-ca-make-annually-revealed put more focus on boosting gross earnings from the F&I department, states Ted Kraybill, president of DeltaTrends, a Clearwater, Fla., seeking advice from company that manages data collection and analysis for the National Automobile Dealers Association Dealership Workforce Study.

"If they're selling more of those products, the F&I supervisors are making more cash (mix a minor in finance with what to make the most money)." According to the 2012 study, F&I managers made a nationwide average of $118,899 in 2011. Compensation ranged from a high of $135,491 in states such as Texas to a low of $103,162 in Midwestern states such as Michigan.

That was the last NADA research study finished before the 2012 study. At mass-market brand name dealerships where the margin squeeze is the biggest, F&I managers now normally make more than sales managers, Kraybill says.

How Much Money Can You Make In Corporate Finance - Questions

In highschool, my buddy and I checked out a huge book of tasks and their incomes. We instantly flipped to the end to find the one that paid the most cash. It was a financial investment banker. Without a second thought, we both stated we were going to be investment bankers.

I wish I had understood how many alternatives I truly had. I could have concentrated on a course that would have been a better fit right from the beginning. Turns out, there's a great deal of tasks that pay a lot of money. Whether you're still in highschool or making a profession modification, you have a lot of choices. Many positions within business financing requires at least a bachelor's degree, and master's degrees or MBAs are frequently chosen. Corporate finance careers have a high earning potential, and numerous corporations offer considerable benefits to their workers. Some professions you might think about in corporate finance consist of: The banking sector offers lots of intriguing career positions, and numerous careers in banking and finance are experiencing job growth.

You may wish to think about tasks like: If you have an interest in finance but desire a customer-focused profession devoted to growing assets, you should highly think about a career in financial investment. Financial investment profession positions are included with the management of properties for specific and corporate clients and make ideas as to ways these individuals and corporations can optimize their gains and prevent costly monetary errors. why do finance professors make more money than economics.

These careers require little, if any, previous work experience and will consist of some level of expert knowing and task training. While a degree is not necessarily a pre-requisite for these jobs, many employers prefer prospects with some college education,, such as a partner or bachelor's degree. The following professions are well-suited for those at the start of their expert practice in finance: Lots of professions within the field of finance are profitable, with incomes well above the mean for U.S.

However, if you just desire to pursue professions that are considered the best of the best you might want to consider the following: Other high-paying financing professions to think about are generally at the management level, which might necessitate more education, such as an MBA. A master's degree or MBA in financing opens the door to brand-new task chances or career development within a finance occupation.

If you're trying to find tasks with a master's in finance, you may want to think about: Internships are a fantastic way to get real-world experience and prepare yourself for working in the field. Lots of degrees in finance either require or provide pertinent internships; some of these are paid, many are not.

About How Much Money Does Business Finance Make

If you're online, you may need to take a trip, though some online schools can help you organize for an internship in your location. Some of the most popular and finest internships in financing are: AT&T Financial and Leadership Advancement Program Northwestern Mutual Financial Network Credit Suisse Lazard J.P. Morgan's Financial investment Bank As you start considering a financing degree and taking a look at schools with financing programs, you must strongly consider the career you're most thinking about, as you might want to customize your research studies to the career paths you desire to pursue.

Some popular market options include banking, insurance, and business financing, and the profession choices readily available within these industries differ. If you have no education or industry experience, it is still possible to acquire an entry level task in finance and work your method up. However, you'll likely have a greater possibility at obtaining work with an associate degree, or, even better, a bachelor's degree in financing.

Finance professionals with more experience and education can move into more complex financing roles or end up being managers who oversee operations and staff members in entry-level positions.

Financing is the lifeblood of business world. Basic material aren't processed, factories aren't developed, items aren't shipped and consumers aren't satisfied unless the cash that makes it occur is present at the correct time and location. It's an understatement to state that the financing industry is big, varied and extremely essential; people in financing careers are individuals who produce, broker and track almost every financial transaction.

Take an appearance at some of the incomes for popular professions in finance: Financing CareerMedian Yearly Income * Actuary$ 100,610 Financial Supervisor$ 121,750 Personal Financial Advisor$ 90,530 Financial Analyst$ 81,760 Securities, Products and Financial Providers Sales Agents$ 67,310 Source: U.S. Bureau of Labor Data' 2018-19 Occupational Outlook Handbook * The salary details noted is based on a nationwide average, unless noted. Actual incomes might differ considerably based upon specialization within the field, area, years of experience and a variety of other elements.

Featured Bachelor's and Master's Programs Practically any financing job will bring you an above average financing salary. And, if you are ready to put in the time and effortsustaining a fair quantity of danger and pressure and performing well in your positiona finance job just might https://www.businesswire.com/news/home/20190806005798/en/Wesley-Financial-Group-6-Million-Timeshare-Debt make you rich. While financial consultant careers sit at the lower end of the finance industry's income spectrum, the U.S.

Our How Finance Manager Make Money PDFs

The financial investment banking field is most competitive and consequently offers escalating incomes, but these tasks are mainly restricted to significant banking centers, such as New York or Los Angeles, and need extremely long hours. Corporate financing tasks sit mid-range, with payment mainly connected to aspects such as the quantity of specific responsibility.

Bureau of Labor Statistics, the demand for finance professions will vary by the location of finance in which you pick to specialize. The recruiting company, Robert Half International, states that while basic unemployment stays high, university-degree holders with specialized skills in areas such as financial analysis will fall well listed below the nationwide joblessness average.

Take a look at how some of the financing professions compare as far as task growth: Actuary18 percent, much faster than averageFinancial Manager 19 percent, much faster than averagePersonal Financial Advisor30 percent, much faster than averageFinancial Expert 11 percent, faster than averageSecurities, Commodities and Financial Providers Sales Agents10 percent, a little faster than average Source: U.S.

In their post entitled "One of the Fastest-Growing Careers is in Desperate Need of Young Skill," Forbes asserts that a person monetary job that's stayed secure and increasingly pertinent in today's market is the monetary advisor. This is since Baby Boomers are approaching retirement and need help https://web.nashvillechamber.com/Real-Estate-Agents-and-Brokers/Wesley-Financial-Group,-LLC-21149?utm_source=GoogleSearch&gclid=Cj0KCQjw3s_4BRDPARIsAJsyoLMcbna5tFxdH9g--Y2UQliNiFGTrCXy6AAE6S9tZYYYuTspQQTsWakaAptfEALw_wcB getting ready for an economically safe and secure future, mainly, and likewise since the typical financing advisor currently working is 50-years-old and nearing retirement also.

What Is The Symbol For 2 Year Treasury Bond In Yahoo Finance Things To Know Before You Buy

"Save as much as possible to have your money work for you tax-efficiently and to get cash in the markets. The first container outside of the emergency fund is the 401( k) approximately the match [if your company offers one] You don't wish to give away free cash." After that, Gould explains, you'll desire to put money in an IRA or a Roth IRA." Another excellent tool individuals do not think about are HSAs," faye wesley jonathan he says, describing the savings accounts for which individuals with high-deductible health insurance here coverage are eligible.

When you turn 65, it turns into an IRA and you don't get punished for using it for other costs you can pay Medicare expenses and long-lasting care premiums." If you maxed out your 401( k) and IRA, next is an investment account, Gould says. "The key is getting involved in the marketplaces." Remaining in the markets is not the like trying to time the marketplaces: Pulling cash in and out to benefit from favorable changes and decrease the loss when the market dips is a method most experts encourage versus.

To take benefit of this result, however, you need to leave your investments alone. And, he encourages, "Do not have more than three to six months sitting in money. Individuals like the convenience of money in cash since they're burned from 2008 and 2009, however inflation will consume away at your money.

Some Known Factual Statements About How To Make Money In Finance

Starting your own organization can be a risky move, however if whatever goes well, it can definitely pay off - how to make big money in finance. Another method to gain the advantages of a successful new startup without the stress of getting a business off the ground is to become a quiet partner who invests capital however doesn't manage any of the day-to-day operations.

You will not have any say in how the company is run or the daily choices active employees make. However you'll earn a cut of any revenues the service makes without putting in any long hours. Nevertheless, you still risk of monetary loss if the venture tanks. If current history has actually taught us anything, it's that housing isn't a guaranteed investment.

Buying property is two-pronged: You could consider purchasing a single house to reside in to be a financial investment, or you might invest beyond your house, into land to offer or stores or homes to lease. Branching out beyond your own home "depends on your market and the cravings for rental realty," Gould states.

Indicators on Scratch Finance How To Make Money You Should Know

Another way your cash can work for you is by increasing your worth on the job market. "If you have time and cash to buy enhancing your education, you can make yourself more valuable to become a higher earner," Gould states. That does not only mean sinking 10s of thousands of dollars into grad school.

Personal Financing Insider offers tools and calculators to assist you make clever choices with your money. We do not provide financial investment recommendations or motivate you to buy or sell stocks or other monetary products. What you choose to do with your cash depends on you. If you take action based on one of the suggestions noted in the calculator, we get a small share of the income from our commerce partners.

Finance tasks can be incredibly profitable professions for people who have strong mathematical and analytics abilities. The market of financing is broad and consists of whatever from banking and financial investments to monetary technology, or Fintech, as it's commonly understood. If you have actually been considering starting a profession in financing however are unsure of which method to go, you're in the best location.

How To Make Instant Money Personal Finance Reddit Things To Know Before You Get This

Finance offers an inspiring number of opportunities to specialize for individuals who have an interest in the field (how do film finance companies make money). These high-paying chances exist in one of six classifications, as explained below: These are primary executives and other tasks at business services and corporations both public and private. These kinds of tasks are typically in a workplace and hold more traditional hours.

Advisors need to combine financial expertise with sales acumen. Financial technology accounts for monetary programmers and even some of what CFOs do. In today's common enterprise company, finance departments support technology facilities allowing for Fintech to overlap a number of http://trevorbopa088.timeforchangecounselling.com/in-order-to-finance-a-new-toll-bridge-things-to-know-before-you-get-this other professions in finance. Financial specialists who operate in financial investments are accountable for putting capital into portfolios that assist people and companies growth wealth.

People who work in lending assistance consumers select loans, or carry out a few of the functional responsibilities of assisting customers safe and secure loans. Quickly apply to tasks with a Certainly ResumeHere are the greatest paying finance tasks: Investment lenders manage the portfolios of organizations and federal government firms that invest in a number of various companies.

How To Make Quixk Money In A Day Google Finance Things To Know Before You Buy

IT auditors typically work for government companies or private companies to validate the technology infrastructure meets compliance needs and other business IT requires. They spend their days carrying out audits and ought to be proficient at doing so, which often requires certification. This is a financial professional who audits an organization for compliance versus requirements set forth by various governing agencies.

Compliance analysts review information, procedure and monetary facilities to guarantee policies are met. These are experts who assist customers identify brief- and long-term financial goals and lead them to items that make sense. The duties of an insurance coverage consultant consist of being well-informed of insurance items, working carefully with underwriters and individuals in danger evaluation and being a main point of contact for customers.

Financial analysts comb through monetary data to help service stakeholders make informed decisions about business finances. They work for financial institutions like banks, funds, insurance companies and more to support the purchasing choices and needs of consumers all over the country. Senior accountants are normally at the top of an accounting hierarchy and are accountable for the daily responsibilities of accounting.

What Kind Of Money Can I Make With A Finance Degree Can Be Fun For Anyone

Hedge fund managers perform comparable responsibilities to investment lenders, but deal with greater danger and benefit portfolios for financiers who pool their capital to make investments in hedge funds. Hedge fund supervisors need to keep track of markets to safeguard financiers, and because of that, they are awake early and leave the office late.

Financial software application developers operate in the growing Fintech area, developing programs that satisfy the requirements of monetary organizations and end-users. These professionals network with investors to get private equity they then use to service financial investments that diversify the financiers' portfolios. The tasks of a CFO are large and consist of overseeing analysts and budgeting, making cost-related decisions about innovation infrastructure and handling monetary groups.

What Does What Is Derivative Finance Mean?

Table of ContentsGetting The What Is The Purpose Of A Derivative In Finance To WorkWhat Finance Derivative Things To Know Before You Get ThisFascination About What Is Derivative Instruments In FinanceMore About What Is A Derivative Finance

Due to the fact that they can be so unpredictable, relying greatly on them might put you at severe financial threat. Derivatives are complicated financial instruments. They can be great tools for leveraging your portfolio, and you have a lot of flexibility when choosing whether to exercise them. Nevertheless, they are also risky investments.

In the best hands, and with the ideal strategy, derivatives can be an important part of a financial investment portfolio. Do you https://www.topratedlocal.com/wesley-financial-group-reviews have experience investing in financial derivatives? Please pass along any words of guidance in the comments below.

What is a Derivative? Basically, a derivative is a. There's a lot of lingo when it comes to finding out the stock exchange, however one word that financiers of all levels should know is acquired because it can take lots of kinds and be an important trading tool. A derivative can take many types, consisting of futures agreements, forward agreements, alternatives, swaps, and warrants.

These assets are usually things like bonds, currencies, products, interest rates, or stocks. Take for example a futures agreement, which is among the most common forms of a derivative. The worth of a futures contract is affected by how the underlying agreement performs, making it a derivative. Futures are typically utilized to hedge up riskif a financier buys a certain stock however concerns that the share will decrease with time, she or he can enter into a futures contract to protect the stock's worth.

The 7-Minute Rule for What Finance Derivative

The over-the-counter version of futures agreements is forwards agreements, which essentially do the exact same thing however aren't traded on an exchange. Another typical type is a swap, which is generally a contact in between two people accepting trade loan terms. This could include someone swapping from a set interest rate loan to a variable interest loan, which can assist them get better standing at the bank.

Derivatives have actually evolved over time to include a range of securities with a number of purposes. Because financiers try to benefit from a cost change in the hidden possession, derivatives are usually used for speculating or hedging. Derivatives for hedging can frequently be seen as insurance coverage. Citrus farmers, for instance, can utilize derivatives to hedge their direct exposure to winter that could significantly reduce their crop.

Another typical usage of derivatives is for speculation when banking on a property's future cost. This can be specifically helpful when trying to prevent currency exchange rate issues. An American investor who purchases shares of a European company utilizing euros is exposed to exchange rate threat because if the exchange rate falls or alters, it might impact their total profits.

dollars. Derivatives can be traded two ways: over-the-counter or on an exchange. Most of derivatives are traded nonprescription and are unregulated; derivatives traded on exchanges are standardized. Typically, non-prescription derivatives carry more danger. Before participating in a derivative, traders should be aware of the dangers associated, consisting of the counterparty, underlying property, rate, and expiration.

What Do You Learn In A Finance Derivative Class - The Facts

Derivatives are a common trading instrument, but that does not suggest they are without debate. Some financiers, notably. In reality, experts now commonly blame derivatives like collateralized debt responsibilities and credit default swaps for the 2008 monetary crisis because they resulted in too much hedging. However, derivatives aren't inherently bad and can be a helpful and profitable thing to contribute to your portfolio, specifically when you comprehend the procedure and the risks (what is a derivative finance baby terms).

Derivatives are among the most extensively traded instruments in financial world. Value of a derivative deal is obtained from the value of its hidden asset e.g. Bond, Interest Rate, Commodity or other market variables such as currency exchange rate. Please check out Disclaimer before proceeding. I will be discussing what acquired monetary items are.

Swaps, forwards and future items become part of derivatives item class. Examples consist of: Fx forward on currency underlying e.g. USDFx future on currency underlying e.g. GBPCommodity Swap on commodity underlying e.g. GoldInterest Rate Swap on interest rate curve underlying e.g. Libor 3MInterest Rate Future on rate of interest underlying e.g. Libor 6MBond Future (bond underlying e.g.

For that reason any changes to the underlying asset can alter the value of a derivative. what is a derivative finance. Forwards and futures are financial derivatives. In this area, I will outline resemblances and distinctions https://www.inhersight.com/companies/best/reviews/overall among forwards and futures. Forwards and futures are very comparable since they are contracts between 2 parties to buy or sell an underlying property in the future.

Not known Incorrect Statements About What Is A Derivative In Finance

Nevertheless forwards and futures have numerous differences. For an instance, forwards are private in between two celebrations, whereas futures are standardized and are in between a celebration and an intermediate exchange home. As an effect, futures are much safer than forwards and typically, do not have any counterparty credit risk. The diagram listed below shows qualities of forwards and futures: Daily mark to market and margining is needed for futures agreement.

At the end of every trading day, future's contract price is set to 0. Exchanges preserve margining balance. This assists counterparties mitigate credit threat. A future and forward agreement may have similar homes e.g. notional, maturity date etc, however due to day-to-day margining balance upkeep for futures, their rates tend to diverge from forward rates.

To illustrate, presume that a trader purchases a bond future. Bond future is a derivative on a hidden bond. Rate of a bond and interest rates are strongly inversely proportional (negatively associated) with each other. Therefore, when interest rates increase, bond's cost reductions. If we draw bond price and rate of interest curve, we will discover a convex shaped scatter plot.

What Jobs In Finance Make The Most Money Can Be Fun For Anyone

They likewise take a look at the "huge picture" of a corporation's financial resources in order to help companies achieve long-term financial objectives. As with lots of professions in economics and finances, there are several different kinds of monetary managers. Some of these consist of insurance coverage supervisors, threat managers, credit supervisors, and controllers, https://b3.zcubes.com/v.aspx?mid=5236987&title=some-known-questions-about-how-much-money-do-finance-majors-make for example. In addition to jobs directly associated to economics and financial matters, monetary supervisors will likewise be accountable for supervisory responsibilities. There's never ever been more of a requirement for personal monetary consultants, which's for a lot of reasons. For one, the rich are getting wealthier, but on the other hand, there are far more self-employed professionals and entrepreneurs who have provided up the security of a standard task for their self-reliance.

If you're making money, you require someone who knows what they're doing to help you handle it. Consult with customers Help clients understand the current state of their finances and consider options Recommend or pick investment strategies Display the progress in customer's investments Typically, to become a financial advisor in a firm, or to hang out your own shingle as an independent consultant, a minimum of a bachelor's degree is more effective.

Private states may require their own licenses; know your state's regulations before you start providing guidance. The Treasury expert is the individual holding the purse-strings; whether at a bank, government company, corporation, or nonprofit, the Treasury Expert supervises financial activity things like cash flow, earnings, credit liability, and all of the assets (real, monetary, and physical) that the organization owns.

As analysts, treasury supervisors will need to see patterns and make forecasts to prepare for the future. Examine and prepare complicated transactions, consisting of international money transfers Organize and keep treasury accounts and procedures Research financing charges and suggest cost-saving steps Manage savings account, financial investments, and offered cash The educational entry requirement is a bachelor's degree, however to rise to the highest level, you'll require a master's degree.

Compliance Analysts are the professionals who comb the policies and treatments of their company to make sure the company is in complete compliance with federal, state, Click for source and local regulations, as well as basic ethical standards and finest practices. In a small company, the same person might be compliance analyst, manager, and officer, however in a large and complex corporation, the Compliance Analyst will work in the compliance department, usually under a supervisor or officer, depending upon the number of branches there are on the business hierarchy tree.

However, the mix of accounting skills, research capabilities to keep up with existing policies, and advanced analytical know-how might make it a good concept to keep going and make the master's degree, specifically if you want to advance. Once April 15 has come and gone, you forget everything about taxes, however tax season is all year wish for a Tax Accounting professional.

In a big corporation, that can suggest working with a team, however many tax accounting professionals find it rewarding to make their own way. Prepare and file earnings tax returns Guidance clients or companies of methods to limit tax liability Submit extensions and guarantee payment of late fines You'll need a minimum of a bachelor's degree to get approved for the Certified Public Accountant exam, which is a need to if you're going to work as a tax accountant.

How Do Film Finance Companies Make Money Fundamentals Explained

If you have actually got those stars in your eyes, you don't need to act, dance, or sing to get to Hollywood; you can be an accounting professional in the show business. Significant studio films and albums are multimillion-dollar projects, and so are significant show trips and festivals, requiring a great deal of investors, and they need more than a few sets of eyes monitoring the budget.

For instance, on high-dollar productions, a production accountant may be on set for the whole of a shoot, making certain whatever last-minute additions the director wants can be made within spending plan. Monitor production expenditures Valuate business, projects, and properties Prepare budget plans for productions To get into the accounting department at a home entertainment corporation, you'll require a minimum of an accounting bachelor's degree and a CPA license - how much money do consumer finance people make.

You may find more opportunities for advancement with a master's degree, however showbiz isn't known for valuing diplomas it's known for valuing guts, smarts, and perseverance. Among the fastest-growing specializations in accounting is Auditor, for excellent factor auditors keep things together. You can be one of two kinds of auditors: you can be the type of auditor that corporations and companies don't wish to see the kind that works for the Internal Revenue Service or another federal government agency or you can be the kind who works to ensure no one ever has to see the very first kind.

Streamline financial record-keeping Assess accuracy of monetary statements and fix up mistakes Evaluation and recommend clients or employers on accounting procedures Offer counsel on in the case of external audits Auditing is an accounting specialty, and more company schools are mytimeshare com including this specialty, together with forensic accounting, to both bachelor's and master's- level programs.

The specialists who are being managed by the Expense Accounting Manager (# 6 above) are the Cost Accountants, who do the analytical and research study work of determining the expenses of production. Expense accountants determine the expense of producing items or supplying services by determining the repaired and variable costs needed for production.

The information collected by an expense accountant is beneficial for budgeting and item pricing, which both affect the future earnings of business. Expense accountants frequently work together with an executive group to develop a financial prepare for the business. Researching and examining costs of production Reporting on findings to managers and executives Developing prepare for decreasing costs To get a job as a Cost Accounting professional, you'll require a minimum of a bachelor's degree in accounting, forensic accounting, accounting info innovation, or a related field.

It's an amusing thing that happens in most companies; budgets are set, money is spent, and if nobody's paying very close attention, the spending will look absolutely nothing like the budget. Budget Analysts are accountable for efficiently dispersing funds and making certain that each department (and irresponsible executive) is investing no more than their budget plan.

Some Known Facts About Which Section Of Finance Make The Most Money.

Offer standards for annual budget plan Consult with managers of each department to figure out needs Approve brand-new expenditures and strategies Monitor spending throughout organization To become a budget analyst, make a bachelor's degree in accounting; expertises in areas like forensic accounting or actuarial science could be particularly useful, because a lot of budgeting involves taking a look at previous budgets for flaws and locations of enhancement. how do finance companies who offer 0% make money.

10 Simple Techniques For Why Do Finance Make So Much Money

Those who attain fellowship status might monitor other actuaries or deal guidance to senior management - how much money can finance degree make per hour. Those who specialize in danger management may become a primary threat officer or primary monetary officer of a company. For monetary advisors, accreditations are vital in order to move up the career ladder. The Qualified Financial Planner (CFP) accreditation might improve a consultant's credibility and subsequently reap new clients, which is essential for success in the field.

If you have a strong flair for numbers, you might be an excellent prospect for a financing major. However, your options post-graduation might not be what you expect. Yes, it's real that a great deal of finance degree graduates end up on Wall Street. Nevertheless, there are numerous other high quality positions delivering a steady job in addition to an outstanding income that fit together well with the finance skill-set.

Throughout your education, you will discover personal finance, accounting, principles of markets, and monetary principles of organization. You'll find out the mathematics associated with cash, and establish skills in stats. But you'll also find out theoretical principles, such as principles in financing and organizational change. You'll learn communication, particularly how to interact complex numbers, which make perfect sense to you, to people who have less understanding of the topic.

This will help you end up being a strong factor to lots of businesses, not just the ones that need someone to run their financial resources. Numerous tasks in the financial sector will need an innovative degree or some kind of job-related experience and one-the-job training. However, these careers enable you to go straight from class to high-paying jobs for financing majors.

The Which Finance Firm Can I Make The Most Money Doing Public Finace Statements

Financial Analyst$ 84,0640 11% Bachelor' sWorking with people or businesses (or both), monetary analysts provide valuable services by helping individuals make choices with their financial resources. They may carry out a large variety of services, including recommendations on investments, evaluating data, studying economic patterns, and preparing composed financial reports. Financial timeshare cancellation industry experts typically work with banks, security firms, and investment firm.

The top 10% in this field enjoy wages over $165,580, making this one of the very best entry-level jobs for financing majors. Maryville University BS in Financial Services Spending plan Expert$ 75,240 7% Bachelor's By preparing budget reports and keeping track of costs, spending plan experts assist numerous organizations stay arranged with their financial resources. Particular duties can include the development of spending plans, evaluating manager strategies, combining department spending plans, and discussing recommendations for moneying demands.

Spending plan analysts have an outstanding median income of $75,240, yet this profession usually just needs a bachelor's degree and no previous experience or specific training. With the top 10% earning over $113,740, it stays a financially rewarding entry-level job for financing majors. Grand Canyon University BS in Finance & EconomicsAccountant & Auditor$ 30,830 10% Bachelor's Focusing on the preparation and evaluation of financial records, accounting professionals and auditors ensure that these files are precise and honest.

With financial proficiency, they could likewise be entrusted with insuring the business runs efficiently from a spending perspective. Accountants and auditors hold an outstanding median wage, but if you work your way into the leading https://www.facebook.com/ChuckMcDowellCEO/ 10% of this field, you can expect profits over $122,220. finance how to make money fast. This gives you a remarkable wage in a field that has a predicted development of over 10%.

How To Use Google Finance To Simulate How Much Money You Make for Dummies